Sony will soon rule the digital image world. It won’t be because of full frame mirrorless cameras or 8K cinema cameras. While those are major components of its imaging portfolio and brand awareness, the camera market for us enthusiasts and pros is becoming increasingly niche.

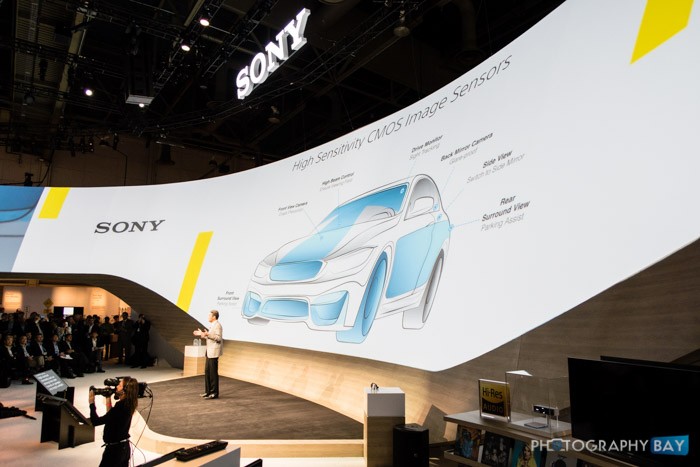

Sony is scaling its CMOS sensor production at crazy levels with no end in sight. Demand continues to increase for image sensors in virtually every consumer product out there. From smartphones to automobiles (the US will require every car built after 2018 to feature a backup camera), everything is requiring more and more cameras.

Cameras are the future of our technology – even if it isn’t the cameras you and I are accustomed to using. Sony’s recent acquisition of Toshiba’s CMOS sensor production is additional evidence that Sony will be one of the few companies that can outsource camera production at scale for virtually every new device that other manufacturers want to build.

Sony is a stakeholder in Olympus. Nikon, Pentax, Phase One and Canon (e.g., G7 X), among other industry players, use Sony sensors in their cameras. Sony, through its wholly-owned subsidiary Sony Semiconductor Corporation, has positioned itself as a manufacturer to win as other camera manufacturers win. On a much larger scale though, Sony’s digital image business is positioned to explode.

As the image sensor business explodes, Sony’s R&D will only continue to outpace other companies who have their hand in the niche camera markets. In the end, this will only lead to better camera manufacturing from Sony and eventually put it in first place in the digital camera market.

In a few days, Sony will hold a press conference at CES 2016. There will be shiny new TVs, phones and cameras for consumers and enthusiasts. Pay attention to the boring business talk though as Sony tosses around numbers about its CMOS sensor production and what kinds of devices they are being used in. That is where the money is at and how Sony will rule the digital imaging world.